About the Lectureship series

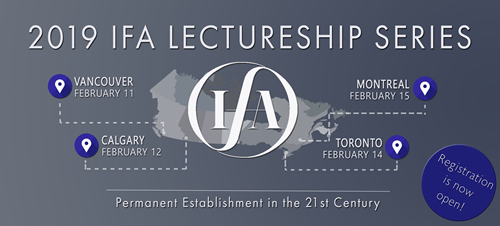

IFA Canada welcomes you to join the 2019 Lectureship series on "Permanent Establishment in the 21st Century" taking place in:

- Vancouver: 11 February

- Calgary: 12 February

- Toronto: 13 February

- Montreal: 15 February

Permanent Establishment in the 21st Century

The definition of permanent establishment in tax treaties has undergone the most significant change in its more than 100-year history. This seminar examines the new definitions in the OECD and UN model treaties, the impact of the BEPS MLI on treaty practice and their implications for cross-border business.

The 2017 OECD Commentary to the model treaty incorporates the 25 issues examined in the pre-BEPS consultation on the meaning of permanent establishment. The utility of the revamped Commentary will be analysed.

Recent case law around the world will be discussed to indicate both administrative and judicial approaches to existing treaty definitions.

Attribution of profits

The Authorised OECD Approach to attribution of permanent establishment profits is now in its 10th year of adoption. The seminar will examine treaty practice in relation to the AOA, the 2010 revised OECD model article 7 and recent case law on profit attribution as well as OECD work post-BEPS on this issue.

Unilateral measures

Unilateral approaches as exemplified by the UK diverted profits tax will be discussed.

Lecturer

- Jonathan Schwarz BA, LLB (Witwatersrand), LLM (UC Berkeley), FTII Temple Tax Chambers, United Kingdom

Language

This seminar will be held in English.

Venue

Pan Pacific Vancouver, 300 - 999 Canada Place, Vancouver

Information and registration

For more information about this event and registration please visit the website: www.ifacanada.org